The Barclaycard Business Premium Plus credit card is designed to offer more than just a way to pay—it brings cashback, travel cover, and lower foreign exchange fees into one package. The question is whether those perks justify its £150 yearly fee. Below is a clear breakdown of what it offers, how it compares with rivals, and who might benefit the most.

Standout Features

- 0% on purchases for six months – A useful breathing space for new businesses covering early costs such as stock, equipment, or services.

- 0.5% cashback on all spending (up to £400 per year) – A steady, simple reward structure. It may not be the most generous rate, but it works across all types of purchases.

- Up to 56 days of interest-free credit – As long as balances are cleared on time, this helps smooth out cash flow.

- Reduced FX charges at 0.99% – A considerable saving compared with the usual 2.99% charged by many providers, especially valuable for businesses paying overseas suppliers.

- Comprehensive travel insurance – Cover for medical emergencies, baggage issues, and flight delays whenever trips are booked with the card.

- Free staff cards with protection – Extra cards come with misuse insurance of up to £15,000, helping employers keep tighter control over employee spending.

- Added perks through Mastercard partners – From AA breakdown services to AXA Health and FreshBooks integration, plus access to Eagle Labs for networking.

How It Works

In practice, the Premium Plus works like a typical business card, but with a few extras tailored for firms that spend regularly or operate internationally. Cashback is credited automatically, insurance applies when travel is booked through the card, and expense tracking is made easier with FreshBooks. The aim is to make managing business finances less stressful.

Comparing Costs

| Feature | Premium Plus | Amex Business Gold | Capital on Tap Business Rewards |

| Annual Fee | £150 | £175 (after year one) | £99 |

| Rewards | 0.5% cashback (capped) | Reward points | 1% cashback (uncapped) |

| FX Fees | 0.99% | 2.99% | 0% |

| Travel Insurance | Included | Optional extra | Not included |

| APR (variable) | 19.3%–55.5% | 26.6% | 29.9% |

Best Suited For

- Startups – The six months of interest-free purchases can ease pressure during the launch phase.

- Businesses with overseas costs – Lower FX fees make paying international suppliers cheaper.

- Firms with staff expenses – Free additional cards, backed by misuse insurance, keep spending under control.

- Frequent travellers – Built-in travel insurance provides peace of mind and saves on extra cover.

Value for Money

At £150 a year, this is not the lowest-cost card on the market. However, a company spending around £80,000 annually would quickly reach the cashback cap of £400, which already outweighs the fee. Add in travel insurance and savings on FX charges, and it becomes a good deal for businesses with significant spending. Smaller firms, however, may find more value in alternatives such as Barclaycard Select Cashback or Capital on Tap, which offer better returns at lower cost.

Final Word

The Barclaycard Business Premium Plus stands out for businesses that deal with both domestic and international expenses. The key strengths are its travel insurance, FX savings, and simple cashback. The main limitation is the capped cashback, which reduces the benefit for companies with very high spending. Overall, it offers a strong mix of rewards and practical features for SMEs that need more than just a standard credit card.

118 118 Money Card: Full Usage Guide, Tips & Real Value <p style='font-size:14px;'>More Than Just Credit Repair: How 118 118 Money Card Fits Real UK Lifestyles</p>

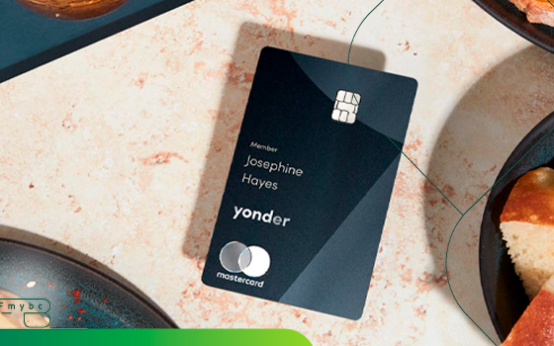

118 118 Money Card: Full Usage Guide, Tips & Real Value <p style='font-size:14px;'>More Than Just Credit Repair: How 118 118 Money Card Fits Real UK Lifestyles</p>  YONDER CREDIT CARD: THE COMPLETE OPTIMIZATION GUIDE <p style='font-size:14px;'>Everything you need to extract maximum value from the UK's most experience-focused card</p>

YONDER CREDIT CARD: THE COMPLETE OPTIMIZATION GUIDE <p style='font-size:14px;'>Everything you need to extract maximum value from the UK's most experience-focused card</p>  How to Use the Amex Gold Card for Maximum Value in 2025 <p style='font-size:14px;'>Advanced Strategies to Maximise Amex Gold UK: Points, Perks & Lounge Access</p>

How to Use the Amex Gold Card for Maximum Value in 2025 <p style='font-size:14px;'>Advanced Strategies to Maximise Amex Gold UK: Points, Perks & Lounge Access</p>