If you’re looking to pay off existing credit card debt without drowning in interest, the HSBC Balance Transfer Credit Card is one of the UK’s most trusted options in 2024. But with stiff competition from Barclaycard, Virgin Money, and MBNA, is HSBC still a good bet?

Let’s break down its features, ideal use cases, and how it stacks up against alternatives.

✅ Key Benefits at a Glance

- 0% interest on balance transfers for up to 18 months

- No balance transfer fee (introductory offer — often time-limited)

- No annual fee

- Minimum transfer amount: £100

- Manage via HSBC Mobile Banking app

- Option to transfer within 60 days of account opening

Unlike many competitors, HSBC periodically offers zero transfer fees — potentially saving you up to £100 on large debt consolidations.

🔍 How It Works (Example)

Let’s say you transfer £3,000 from another credit card.

- If done within the promo window, you pay £0 in fees

- You pay £0 interest for 18 months

- Monthly payments: You can repay around £167/month and clear the balance interest-free

➡️ Total interest saved: ~£690 (assuming 24.9% APR elsewhere)

💡 Note: If you miss a payment, you lose the 0% offer, and standard APR applies.

⚖️ HSBC vs Other 0% Balance Transfer Cards (2024)

| Feature | HSBC Balance Transfer | Barclaycard Platinum | Virgin Money Balance Transfer |

| 0% Duration | Up to 18 months | Up to 30 months | Up to 27 months |

| Balance Transfer Fee | ❌ None (limited time) | ✅ ~3.45% | ✅ ~2.79% |

| Annual Fee | ❌ None | ❌ None | ❌ None |

| Application Simplicity | ✅ Bank-grade portal | ✅ | ✅ |

Verdict: HSBC wins on fee savings, while Barclaycard dominates on 0% duration.

🧍 Who Should Consider This Card?

- Anyone with £1,000+ in high-interest credit card debt

- Budget-conscious borrowers looking to avoid transfer fees

- Existing HSBC customers wanting full control in one app

- People with good to excellent credit scores (score > 720)

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>  HSBC Commercial Card Review <p style='font-size:14px;'>Unlock financial flexibility, earn rewards, and streamline expenses with the HSBC Commercial Card. Elevate your business today! </p>

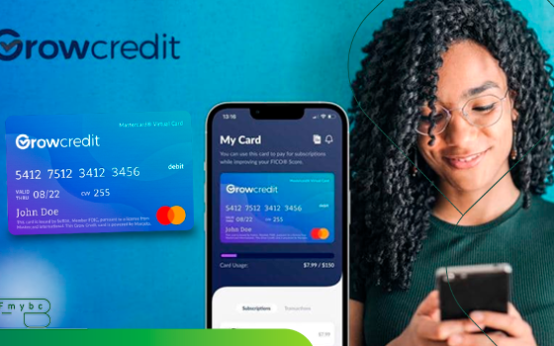

HSBC Commercial Card Review <p style='font-size:14px;'>Unlock financial flexibility, earn rewards, and streamline expenses with the HSBC Commercial Card. Elevate your business today! </p>  Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>

Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>