The best credit cards on the market offer several benefits, such as lengthy promotional APRs on purchases or balance transfers, big sign-up bonuses and no annual fees. If you add up these perks, you’ll probably find a total of $1000 for the top credit cards. But how to choose a credit card?

The best credit card for you will depend on your needs, spending habits and financial goals. Well, you can ask these questions as you narrow your search:

What’s your credit score?

To choose a credit card, you need to know that card issuers primarily look at your credit score and income to determine approvals, so you need to check your credit. Normally, the higher the score, the better the benefits and rewards.

Do you tend to carry a balance?

If you tend to carry a balance, a low interest or non-rewards zero interest credit card is a better choice than a rewards credit card, given you’re likely to lose any points, miles or cash back you earn to interest.

Are you currently carrying high-interest credit card debt?

If so, a balance transfer credit card with a long 0% introductory APR window or a waived balance transfer fee is the best option for you.

Are you a transactor?

That means you charge most purchases to a credit card, but pay them off in full each month. In that case, a rewards credit card is the best card for you because you will get a return on your spending.

Can you recoup an annual fee?

This is one of the most important questions that will help you to choose a credit card.

Not always the cards with an annual fee are bad. If you charge a lot and pay your balances in full each month, they can be an excellent option. They usually have the most lucrative perks and big transactors are likely to recoup the charge.

Are you looking to earn cash back or miles?

Travel credit cards offering points or miles can be quite lucrative, but cash back cards are generally very easy to enjoy, especially when it comes time to redeem.

Do you favor a certain airline, hotel or retailer?

Co-branded cards usually have a good return on those specific purchases, plus extra benefits that make them a worthwhile addition to your wallet.

Are you looking for a sign-up bonus?

Some cards have a welcome bonus which lets you earn bonus rewards in your first year if you spend a certain amount of money in a set time frame (usually within your first three months).

Do you already have a credit card?

It’s common to carry more than one credit card, given your financial profile and goals change over time. But you need to be a disciplined spender. If you do this strategy, maybe you can get even more bang from your buck.

What to consider when comparing credit card features

When choosing the type of card that’s right for you, ask yourself which of the following features you hope to avoid and which you absolutely can’t do without:

Fees: not all credit cards charge an annual fee, but those who do usually offer better perks and consumer protections.

Interest rates: issuers usually offer a lower intro interest rate when you first join, lasting anywhere from six to 18 months. After this time, the regular interest rate kicks in and it’ll depend on your credit and other factors.

Benefits and rewards: normally, the higher your annual fees the more premium your perks will be. But, you need to consider not only the reward rate per dollar but also the value of those rewards and ease of redemption.

Introductory bonus: the welcome bonus is often given in the form of points or cash after the new cardmember spends a certain amount within a given period of time. But in this case, bigger isn’t always better. In the event of inflated points, a 100,000 point bonus may not get you as much as you think when it comes time to redeem. For some, spending to meet the bonus threshold could leave them with a debt that is difficult to repay, especially when the regular APR period begins.

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>

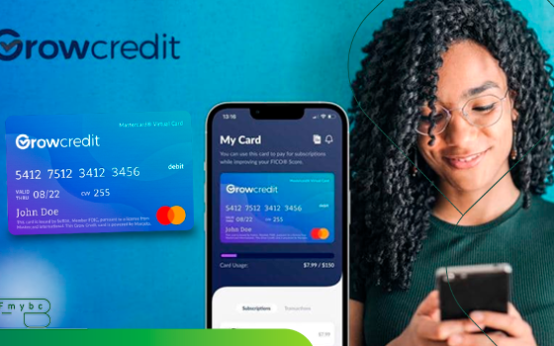

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>  Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>

Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>  Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>

Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>