Put the power of banking in the palm of your hand with Farmers’ mobile banking solutions. With their Online and Mobile Banking you can manage your finances anytime, anywhere 24/7.

Moreover, what makes this card unique and one of the best low interest credit cards is because it offers a lengthy 0% APR offer on both purchases and balance transfers.

Pros & Cons

Pros

- Low introductory rate for an extended time

- Ability to pay down other balances

- Saving on interest

- Extended warranty coverage

- Auto rental collision damage waiver coverage

- Zero fraud liability

- No annual fee

Cons

- Requires good/excellent credit

- No bonus offer

Rates, fees & offers

- Annual fee: $0

- Rewards rate: N/A

- Bonus offer: None

- Intro APR: 0% on Purchases and Balance Transfers for 20 billing cycles

- Ongoing APR

APR: 13.49% – 23.49% Variable APR

Cash Advance APR: 25.99%, Variable - Balance transfer fee: 3%

- Foreign transaction fee: 3%

Review

Identity Theft Protection

Identity theft strikes nearly 100,000 people in the United States a day! Being an unfortunate victim of this crime can cost you time and money.

Farmers National Bank is committed to assisting its customers protect their private information. They offer PROVENT® ID Protect Plus to help protect their customers’ personal information..

Online bank

Online Banking at Farmers puts you in control of your money as well as your time.

With the Online and Mobile Banking you can manage your finances anytime, anywhere. You can check your account balances, pay bills and make transfers – safely and securely. Bill Pay, eStatements and the payment platform Popmoney® are some of the excellent services that come with Online Banking.

0% Introductory Rates

The Farmers National Bank Platinum Visa Credit Card offers an introductory 0% APR period on purchases and balance transfers made in the first 20 billing cycles.

After that, the standard APR will apply (currently 13.49% – 23.49%). In order to benefit from the introductory APR, you should aim to pay off your entire balance before the introductory period ends.

How to request this card

Applying for a credit card is very simple and you can do it through the app or website. But you need:

- Social Security Number

- Gross income

- Employer name (if applicable)

- Rent/mortgage amount

Did you like this card? Click on the button below and get yours right now.

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>

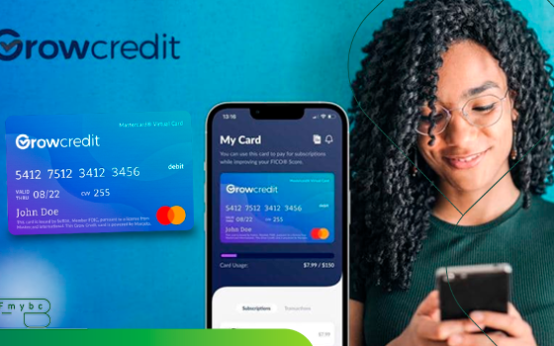

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>  Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>

Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>  Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>

Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>