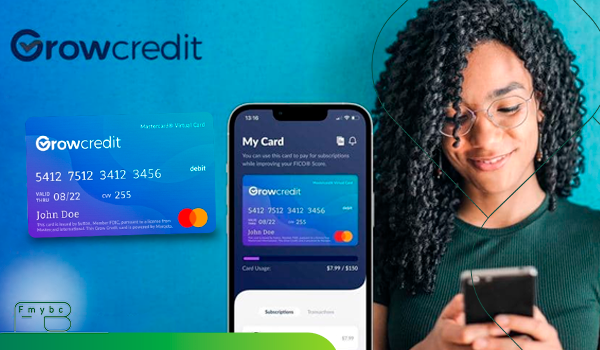

Introducing the Grow Credit Mastercard, your ultimate partner in building and enhancing your credit profile. Whether you’re embarking on your credit journey or seeking to strengthen your financial standing, this card offers a seamless blend of credit-building benefits and everyday practicality.

Designed with your financial growth in mind, the Grow Credit Mastercard simplifies the process of improving your credit score while offering valuable features to support your goals. Elevate your financial future and take control of your credit with a card that’s as dedicated to your success as you are.

Grow Credit Mastercard Benefits

- Elevate Your Credit Score: The Grow Credit Mastercard is designed to help you enhance your credit rating with responsible use. Consistent, on-time payments with this card can lead to significant improvements in your credit profile, setting you up for future financial success.

- No Security Deposit Required: Start building your credit without needing to lock away funds. The Grow Credit Mastercard eliminates the need for a security deposit, making it an accessible tool for those looking to boost their credit score without upfront costs.

- Wide-Ranging Usage: This card offers the flexibility to cover all types of expenses, from everyday purchases to larger expenditures. The Grow Credit Mastercard adapts to your spending needs while aiding in your credit-building journey.

- Monthly Updates to Credit Bureaus: Benefit from regular updates to major credit bureaus each month. The Grow Credit Mastercard ensures that your positive payment behavior is reported consistently, helping to build and maintain a strong credit history.

- No Annual Fee: Enjoy all the benefits of the Grow Credit Mastercard without incurring an annual fee. This cost-free feature makes it an economical choice for anyone looking to enhance their credit profile.

- Access to Financial Insights: Take advantage of comprehensive financial education resources provided with the Grow Credit Mastercard. These tools are designed to help you make informed decisions about your credit and finances.

- No Initial Credit Check: Begin your credit-building journey without the obstacle of a credit check. The Grow Credit Mastercard is available to individuals regardless of their current credit standing, making it easier to get started.

- Credit for Subscriptions: Use the Grow Credit Mastercard to earn credit on recurring subscription payments. Whether for streaming services or utilities, these regular expenses contribute to your credit improvement.

- Consistent Credit Reporting: Watch your credit score grow with monthly reporting to all major credit bureaus. The Grow Credit Mastercard supports your credit-building efforts by keeping your on-time payments visible.

- Flexible Credit Limits: Adjust your credit limit to suit your financial needs. The Grow Credit Mastercard offers customizable limits, allowing you to manage your spending and credit-building goals effectively.

- Convenient Automatic Payments: Simplify your financial management with automatic payments. The Grow Credit Mastercard allows you to set up automatic bill payments, ensuring timely payments and avoiding late fees.

- Easy Online Management: Access and manage your Grow Credit Mastercard account effortlessly online. The user-friendly portal provides tools to track spending, monitor progress, and handle your account with ease.

Who Can Apply

Here’s a clear breakdown of the criteria for applying for the Grow Credit Mastercard:

- Age: Applicants must be at least 18 years old.

- Income: A steady source of income is required, though specific income thresholds are not set.

- Residency: Must be a resident of the United States.

- Credit History: While the card is designed for building or rebuilding credit, a minimal credit history or previous financial behavior may still be considered.

How to Apply

- Check Eligibility: Ensure you meet the basic requirements, such as age, income, and residency.

- Complete Application: Fill out the online application form with your personal and financial details.

- Submit Documentation: Provide any necessary documentation, such as proof of income or identification, if required.

- Review Terms: Read and review the card’s terms and conditions before finalizing your application.

- Submit Application: Submit your completed application and wait for approval.

Grow Credit Mastercard Frequently Asked Questions

- How often is my credit activity reported?

- Your credit activity is reported to major credit bureaus on a monthly basis.

- Can I use this card for international purchases?

- Yes, you can use the Grow Credit Mastercard for international purchases. Be aware of any potential foreign transaction fees.

- How do I apply for the Grow Credit Mastercard?

- Complete the online application form, provide necessary documentation, and review the card’s terms before submitting your application.

- What if I have a question about my account?

- You can contact customer service through the number provided on the back of your card or visit the card issuer’s website for support.

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>  Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>

Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>  Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>

Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>