Imagine transforming every dollar spent and every mile traveled into significant rewards and exclusive perks. This card is more than just a financial tool; it’s your gateway to a premium travel experience.

Designed for the frequent traveler and the discerning spender, this card offers unparalleled earning potential on miles and an array of benefits that cater to your travel desires. From luxurious travel perks to flexible redemption options, it’s crafted to elevate every aspect of your travel lifestyle.

Unlock a world of adventure and luxury with every swipe!

Pros:

- Generous Miles Accumulation: Accumulate miles rapidly with competitive earning rates on both everyday spending and travel expenses.

- Elite Travel Benefits: Access exclusive perks such as airport lounge access and priority boarding, enhancing your travel comfort.

- Versatile Redemption Choices: Use your miles for flights, hotel accommodations, or cashback, offering flexible reward options.

- Comprehensive Travel Insurance: Travel with confidence, knowing you’re protected with extensive travel insurance coverage.

- No International Fees: Enjoy global use of your card without incurring extra charges on foreign transactions.

- Attractive Signup Offers: Benefit from compelling introductory bonuses and additional miles upon initial registration.

Cons:

- Annual Fee: The card incurs an annual fee, which may be higher than other credit card options.

- Higher APR: A relatively high APR could increase costs if balances are carried over.

- Credit Score Threshold: Eligibility requires a higher credit score, potentially limiting access for some applicants.

Why Should You Consider This Card?

If you’re a frequent traveler or someone who loves to make the most out of every dollar spent, this credit card is designed with you in mind. It offers a wealth of rewards and benefits that can transform your spending into memorable travel experiences.

With generous earning rates on miles, exclusive travel perks such as airport lounge access, and flexible redemption options, this card turns every purchase into a step toward your next great adventure. Whether you’re booking flights, reserving hotel stays, or simply enjoying cashback, the rewards potential is substantial and tailored to elevate your lifestyle.

Additionally, this card’s comprehensive travel insurance and lack of foreign transaction fees provide added peace of mind and convenience for globetrotters. While it does come with an annual fee and higher APR, the value offered through its rewards program and exclusive benefits often outweighs these costs, especially for those who travel frequently or seek premium perks.

By choosing this card, you’re not just making a financial decision—you’re investing in a superior travel experience and a more rewarding way to manage your expenses.

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>

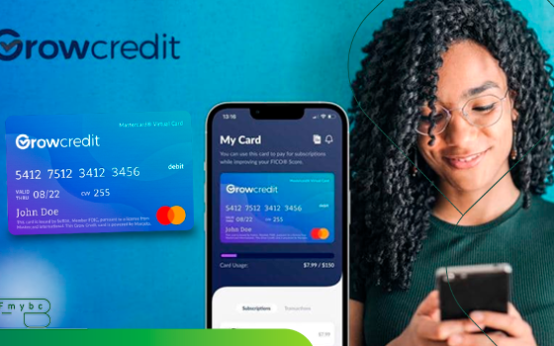

Chase Freedom Cards: How to Choose, Use, and Save <p style='font-size:14px;'>Dive deep into Flex, Unlimited, and Rise to earn more and spend smarter</p>  Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>

Revisión De La Tarjeta Grow Credit Mastercard <p style='font-size:14px;'>Si buscas una manera efectiva y sin riesgos de mejorar tu crédito, la tarjeta Grow Credit Mastercard es una excelente alternativa.</p>  Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>

Revisión De La Tarjeta de Crédito Current Build Visa <p style='font-size:14px;'>Si estás listo para tomar el control de tus finanzas y mejorar tu crédito, la tarjeta Current Build Visa es tu mejor opción. </p>